As I watched Powell give his speech yesterday, I had to keep pinching myself to check that I wasn’t dreaming. The technocrats who’ve run the world economy since the Volcker Coup finally seemed to get it. Could this really be happening? Could they really have kicked the old habits of mind and embraced the New Empiricism? Evidently, they could. In what follows, I will give a short account of the intellectual and political economy revolutions unfolding before our very eyes. I will argue that we are not only at an inflection point in the modern history of the world economy. We may, in fact, be at the turning point of the secular cycle. The present revolutions in US political economy, I will argue, constitute nothing less than a final break with neoliberalism.

Short-term and long-term movements are always superimposed, Braudel told us. But can they be disentangled? In his three-volume magnum opus published in 1979, Civilization and Capitalism, Braudel prophesied that the downturn in 1973-1974 was not a short-term conjuncture, but in fact a turning point in the secular cycle:

What about 1973-1974 then? Is this a short-term conjunctural crisis, as most economists seem to think? Or have we had the rare and unenviable privilege of seeing with our own eyes the century begin its downward turn? If so, the short-term policies directed towards immediate ends, advocated by our political leaders and economic experts, may turn out to be powerless to cure a sickness which our children’s children will be very lucky to see the end.

Braudel, Civilization and Capitalism, Vol. III. Harper and Row: New York, 1984, p. 80.

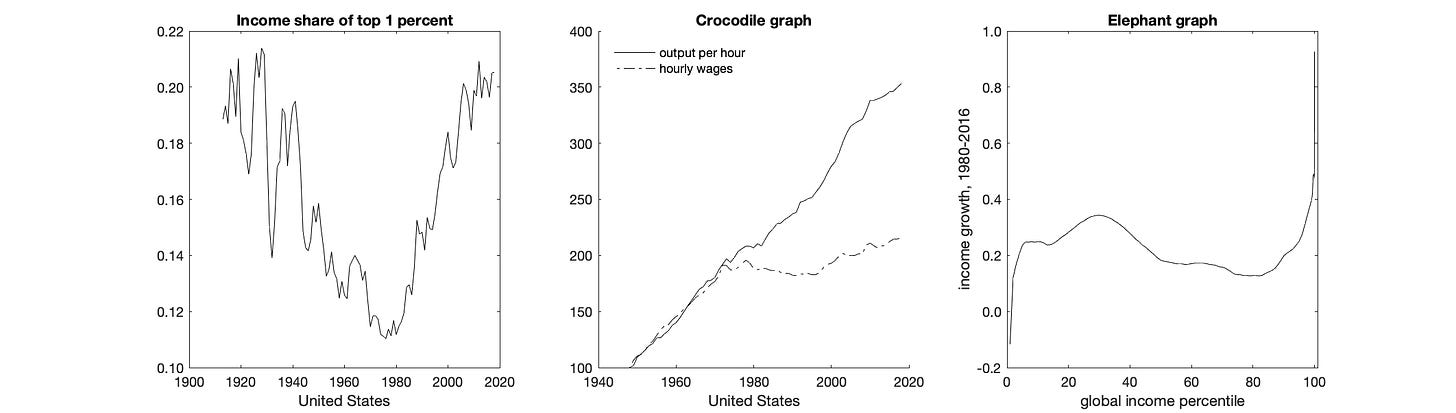

Braudel’s prophecy has since obtained. In 1960-1973, US productivity, as measured by real output per hour, grew at 2.8 per cent per annum. Since 1974, productivity has grown at only 1.8 per cent. Real GDP per capita grew at 2.9 per cent in the former period, but only 1.6 per cent per annum in the latter period. But even this lower rate of growth was cornered by the upper classes. Three graphs capture what has happened to the world economy since Braudel called the turning point of the secular cycle. The first graph shows that, since the 1970s, the income share of the top 1 percent has been restored to the level last attained in the early-twentieth century. The second shows that a yawing gap has opened up between productivity and blue-collar wages over the same period. And the last graph shows that the working classes of the advanced economies have mostly missed out on income growth since the Volcker coup in 1979.

These large-scale economic patterns are rightly traced to the ideology and practices of neoliberalism. At the heart of this new ideology were three developments. The first and most important development was the capitulation of social democracy. The stagflation crises of the 1970s was blamed above all on the political economy of Keynesian macroeconomic stabilization. In what came to be the received wisdom, an excess of democracy was held to be responsible for the onset of macroeconomic instability. Management of the macroeconomy, it was felt in elite circles, could not be left to the politicians, whose short-term horizons threatened price stability. Insulated from democratic pressures, better-informed and disinterested technocrats would shepherd the economy instead. By the mid-1990s, politicians across the West had almost completely relinquished their power over economic affairs and yielded their authority to unelected technocrats.

The second development was the rise of the idea that the large-scale coordination of economic activity was best left to self-regulating market forces. Left to fend for themselves, all economic actors would face the right incentives. This alignment of incentives with economic realities would lead to the most efficient allocation of scarce resources and thereby generate faster growth. This was more than a simply general purpose free-market ideology of the sort that the British peddled in the nineteenth century. Instead, the new way of thinking embraced market discipline, which was seen as the only solution to the specific problem of the secular decline in profit rates of American industrial firms in 1966-1983. As I explained in The Logic of Discipline in US Manufacturing:

How was dynamism to be restored in the heart of America’s industrial economy? What was required, it was felt in forward-looking circles [around 1980] and would soon become received wisdom, was a thorough-going reconstruction of the rules of the game. The diagnosis explained the loss of dynamism by the ossification of American industrial capitalism. If the United States was going to emerge from rust-belt pathos, the Chandlerian firms would have to become more competitive. Put simply, dynamism was to be restored by going back to the basics. Chandlerian autonomy had to give way to the logic of discipline.

More precisely, the loss of dynamism in the great industrial firms was to be restored by subjecting them to the supervision of Wall Street. Unfettered finance was at the very heart of the neoliberal counterrevolution. The whole of the world economy was to be subjected to the disciplinary force of the financial markets. At the heart of this ideology was the efficient markets hypothesis which said that capital markets are efficient — no actor in the economy, including and especially political authority, can beat the judgement of the financial markets. In practice, this meant the development of an ensemble of institutions whereby the fortunes of firms, governments, and communities were to be governed by the judgements and perceptions of traders and financial analysts working for banking firms in New York. This was a recipe for the restoration of the revenues of the upper class without doing anything to solve the problem of the loss of dynamism.

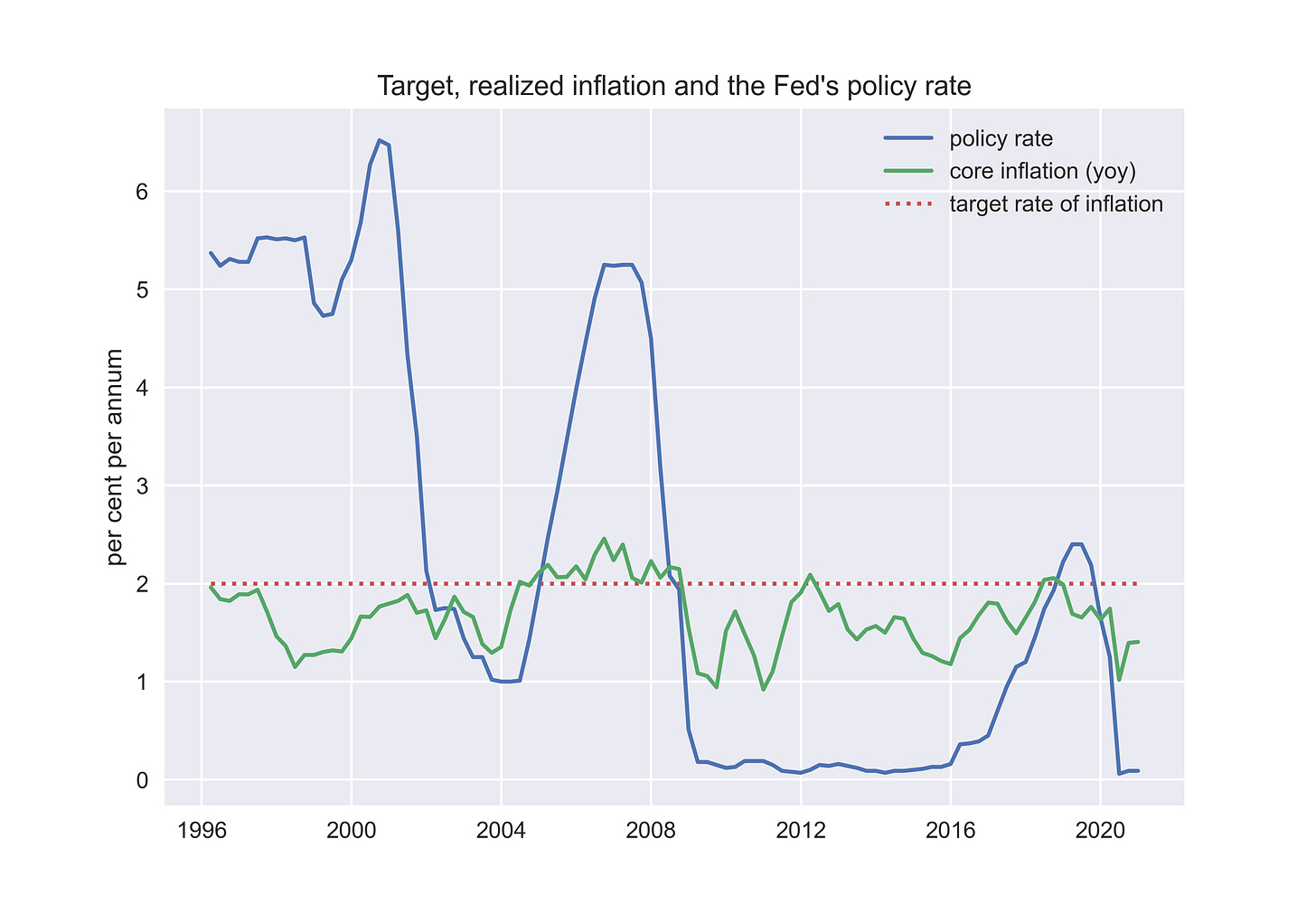

The third development was in the heads of the technocrats. The great lesson of the stagflation crisis of the 1970s was that the central bankers had to be extremely vigilant against inflation. Whatever the mandate set by Congress, the main job of the central bankers was to ensure price stability. Above all, it was realized that once inflation expectations got de-anchored, it was very painful to bring them down again. So the Fed and other hard currency-issuing central banks began to hike in anticipation of inflation. Inflation expectations in the United States were firmly anchored on target by the mid-1990s. But for the next twenty-five years, despite the virtual absence of above-target inflation, the Fed kept hiking every time its models suggested that inflation was around the corner.

The Fed said that the 2 percent target was symmetric. But in practice, the Fed’s reaction function was asymmetric. The asymmetry of the Fed’s response was so strong that it generated a systematic bias in the Fed’s forecast and actual inflation. While the technocrats at the Fed have persistently expected long-run inflation to be 2 percent, actual inflation has undershot the target in 80 percent of all quarters since 1995. But the problem went even deeper than the asymmetric response function of the Federal Reserve.

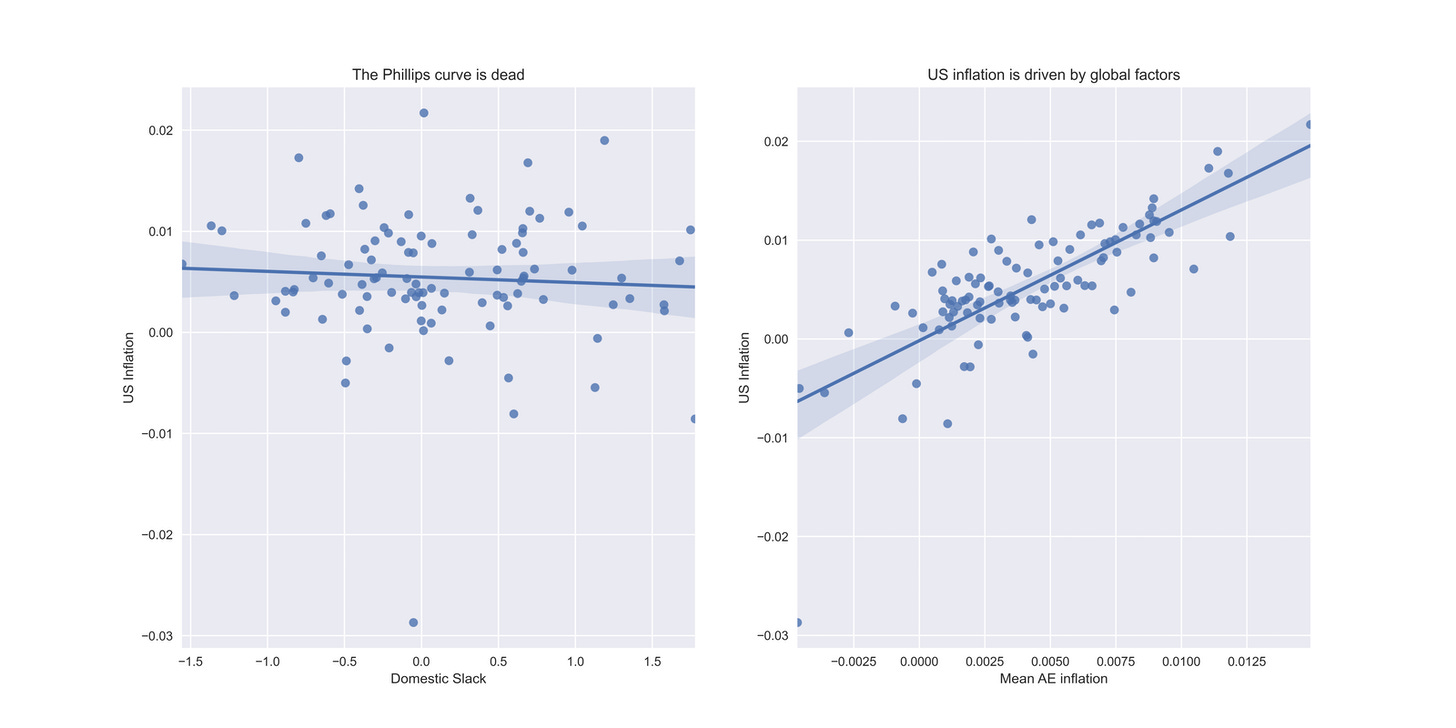

Long after its demise, the technocrats continued to believe and rely on the Phillips curve model of inflation which said that we should expect inflation to rise whenever labor markets tighten sufficiently enough. This theory of the inflation process was baked into every single quantitative model of the economy ever considered by the central bankers. But the inflation process had transformed out of recognition by the system-wide buildup of overcapacity and the rise of global value chains. What has determined inflation since at least the mid-1990s is not the tightness of domestic labor markets, even in the world’s largest economy, but the degree of slack in the global production system as a whole:

Where there should’ve been a new theory of the inflation process, there remained a mental rigidity acquired when the central bankers had been in graduate school at Berkeley and MIT in the 1970s.

These three rigidities of the mind structured the Fed’s reaction function, the logic of financial discipline to which all economic actors were subjected, and the possibility space contemplated by political authorities. This was the process of structuration that generated the secular downward cycle of the past fifty years. What has happened since the financial crisis is the process of destructuration whereby these intellectual rigidities have been abandoned one by one.

The first to go was the belief in the wisdom of financial markets. This was a direct consequence of the global financial crisis. Wall Street’s pretenses of being the smartest guys in the room were irredeemably destroyed when the market-based credit system erected by the dealers endogenously generated the greatest risk to economic fortunes world-wide since the 1930s. Despite suspicions that nothing much had changed at all, the megabanks were, in fact, tied down with a whole series of regulations that gave the Fed the authority to directly control their capital ratios, liquidity ratios, and even decisions on whether and how to reward their shareholders. We are very far from high neoliberal global financial intermediation. What we had in 2006 was unfettered global finance; what we have now is global finance closely supervised and controlled by technocrats at the Fed, whose authority has increased in leaps and bounds. So, a central structural feature of neoliberal political economy was unmade quite early on after the financial crisis.

For a few years, this seemed to be enough. The political authorities and the technocrats came to believe that the Band-Aid was enough to restabilize the system. This was the ‘false dawn’ of the 2012 election that Adam Tooze wrote of in Crashed. In reality, the process of destructuration was far from complete. This was the risk of writing contemporary history for Tooze. Just as he began writing the conclusion to Crashed, the stable world that the Obama-era elites believed they had achieved began to unravel at the hands of forces that they were completely unaware of.

They knew that the neoliberal institutions had destroyed the working-class. The New Economy that obtained with the capitulation of social democracy had led to the rise of an overbearing class of prestige-schooled meritocrats who began to claim a larger and larger share of the income, esteem and even work. What obtained then was an ‘hourglass’ occupational structure where most of the new jobs created were either for the highly-skilled meritocrats who run everything from the New York Times to Goldman and Google, or for unskilled day laborers at fast-food chains and grocery stores. This dual economy echoed the Lewisian model in monstrous reverse: instead of workers leaving the traditional low-productivity sector for the modern high-productivity sector, working-class breadwinners were pushed out of middle-skilled occupations that vanished from the industrial sector and into either the low-productivity sector or to the margins of employment and a life of dependence and indolence.

The New ‘Hourglass’ Economy undermined the reproduction of the working class family, even as the middle class family was restabilized with divorce rates and child out of wedlock-rates falling for the latter but not the former. The unraveling of working-class families and communities led to an epidemic of ‘deaths of despair’ starting in 2000. Yet, for 15 years no one even noticed. It was only in 2015 that Case and Deaton would document the wholly exceptional rise in ‘deaths of despair’ among whites without college degrees — the bulk of the American populace.

Elite-mass relations began to break down almost immediately as anger among ‘the losers of neoliberal globalization’ began to grow. The blame was not placed on the owners of capital and corporate power of the Marxian imaginary, but rather on the new class of meritocrats who began to dominate the airwaves over ‘flyover country’ in a one-way traffic of symbolic production emanating from the coasts. The hated ‘coastal elites’ in turn began thinking of working class whites as stupid racist bigots who didn’t know what was good for them — this was the development that Thomas Frank described in his 2004 polemic, What’s the Matter With Kansas?

Even as working class whites increasingly abandoned the Dems for the GOP, the latter continued to espouse free-market orthodoxy and cultural hot-button issues that did nothing at all to address the elephant in the room — the decline of working-class families and communities with the vanishing of broad-based growth. The brutal process of downward mobility was accompanied by the demise of institutions that intermediated between the working-class and the political and economic elites, that Putnam has documented. All organic connections between elites and masses were thus severed with ‘the big sort’ whereby the social classes became geographically segregated from each other over time.

These developments left late-neoliberal elites completely clueless about what was happening to the middling bulk of American society far from New York and San Fransisco. So when Donald Trump came down that escalator, he was simply dismissed as a buffoon. No one among the elites saw the threat in real time. But Trump had inadvertently tapped into something altogether bigger than electoral politics. To mix metaphors, Trump was carried along the tide of history by the tectonic forces of class politics. The masses had simply had enough of the fucking technocrats from Harvard and Yale. By 2015, they were ready to burn the world constructed by the elites to the ground.

Even after the shock of 2016, elite resistance to the recognition of political realities remained in place. But the process of destructuration began to accelerate. Elites became more and more convinced that something — anything — had to be done to re-stabilize the system and contain ‘the threat from below’ revealed by 2016 [Richard F. Hamilton, 1972]. Yet, metal rigidities continued to thwart real solutions. Stuck with the old habits of thought, the Yellen Fed began hiking in anticipation of inflation as labor markets tightened in 2016. Democratic primary voters threw their weight behind the equivalent of a safety school despite a charismatic cast of pretenders.

The first intimations of a structural break with the old ways of thinking began to emerge in the discourse of the New American Left. Although it would later be taken over by antiracist activists unconcerned with the fortunes of the working-class, Bernie’s revolution was initially focused on bread and butter issues of everyday people. While Democratic primary voters could not be persuaded to cast their lot with the radicals, the ideas that emerged on the left of the party would strongly condition what was to come later, after the pandemic. What was truly pathbreaking about the new intellectual movement afoot was the complete abandonment of any commitment to fiscal discipline. MMT was only the tip of that iceberg. The general idea gaining adherents on the left was that power was to be taken back from the technocrats by political authority and the state’s capabilities to improve the lives of people was to be reconstructed.

Before the pandemic, this idea of breaking completely with the neoliberal playbook was contained. A half asleep old white guy would be put in the White House by the risk-averse Democratic majority. So it seemed for a while that neoliberalism was to be resurrected. But the Schmittian emergency of the pandemic brought these ideas back to the center of the policy discussion. Power was to be taken back from the technocrats after all. The intellectual revolution within political circles was accelerated by the constraints of the electoral clock. After winning the Senate runoffs in Georgia, the Dems now owned all federal policy. And they had two years to show their work — otherwise they’d lose control of Congress. The idea thus began to emerge among Democrat political strategists that you had go in heavy with all guns brazing right from the start. This is how we got the $1.9 trillion package.

Meanwhile, frustration had been building among the technocrats themselves. With the policy rate close to the zero lower bound, they had been pushing on a string with bond purchases which stimulated asset prices but have only a weak effect on economic activity because the rich refused to spend their capital gains. The desire to effect a handover to fiscal policy thus began to grow. The Fed responded to the pandemic by pulling out the bazooka. But that was not nearly good enough. The desire to handover control over economic affairs to the politicians became all-consuming in 2020.

With the Biden White House contemplating a $1.9 trillion fiscal package, the only question was whether the Fed would play along. Would they start hiking in anticipation and kill the party before it got started? The answer became crystal clear yesterday.

Lael Brainard, the real hero of the story, had been the lone voice at the Federal Open Market Committee (FOMC) arguing for abandoning the old way of thinking about the inflation process in the mid-2010s. The daughter of a US diplomat, she was born in Hamburg and grew up in West Germany and Poland before moving stateside for college. She read at Wesleyan and got her doctorate from Harvard. After a brief stint at McKinsey, she taught at the MIT Sloan School of Management, where she got tenure after making many scholarly contributions to international economics. Her public service career began when, in 1997, she was appointed as a deputy national economic advisor in the Clinton White House. She later led the international section of the US Treasury under Obama during the Greek Crisis. Her nomination to the Fed Board for 14 years was confirmed by the Senate in June 2014. She was sworn in by Fed Chair Janet Yellen.

In 2015, she gave a “blunt speech” warning against prematurely lifting rates given subdued inflation and considerable labor market slack. “A variety of econometric estimates would suggest,” she explained in her speech, “that the classic Phillips curve influence of resource utilization on inflation is, at best, very weak at the moment.” FT’s Gavyn Davies declared that “This week’s “rebellion” within the [Fed] board was led by Lael Brainard…”. He elaborated:

In a speech notable for its clarity, she directly opposed several of the main planks in the Yellen/Fischer orthodoxy (see Tim Duy and Paul Krugman.) For example, she said that the Phillips Curve was an unreliable guide to future inflation rates; that the predicted rise in the equilibrium real interest rate might never happen; and that the appropriate management of inflation and recession risks clearly pointed towards long term dovishness.

Another respected FT commentator, Martin Sandbu, wrote of a “Mutiny at the Fed.” Ultimately, Yellen would arm-twist the younger woman to not formally dissent from a rate hike in December 2015. But Brainard’s war on the old way of thinking about inflation and monetary policy would continue. Her ideas got a shot in the arm when, in 2017, Bernanke proposed price-level targeting instead of inflation targeting. The proposal contained an implicit but damning critique of Fed policy. What it showed was that the Fed had been wrong to hike in anticipation of inflation — Fed policy, including and especially forward guidance, had been way too tight. On the same day, Brainard gave a speech at the Peterson Institute for International Economics where she favorably reviewed Bernanke’s proposal.

In her remarks following Bernanke’s speech, she declared bluntly that “The Phillips curve is just not very important as part of the inflation process.” This blasphemy immediately invited the wrath of the former chief economist of the IMF who would become the President of the American Economic Association next year, Olivier Blanchard: “The notion that a tight labor market will lead to inflation is impossible to contradict.” Blanchard’s remark revealed the mental rigidity of the technocrats with unusual clarity. What it also made clear was that Brainard was still fighting an uphill battle. But her new way of thinking about inflation, supported by research from the Bank of International Settlements and a host of younger economists, began to gain influence within the FOMC.

Even before the pandemic, the Powell Fed had been moving to an empirical stance — actually waiting for inflation to overshoot instead of relying on model predictions ultimately based on the defunct Phillips curve. With the shock of 2016, the technocrats began to pay more careful attention to how their policies affected the fortunes of the working-class. They realized that containing ‘the threat from below’ actually required making progress on broad-based growth — the objective that had been abandoned in 1979. As the evidence began to come in after 2016 that one could run very tight labor markets without inflation reappearing, Brainard’s way of thinking became more and more compelling.

The central bankers had come to realize that the only way to achieve broad-based growth was to run the economy really hot. Only when labor markets get very tight do working-class wages start growing as fast as middle class salaries. This idea of running the economy really hot to deliver broad-based growth could only work because, while inflation does not respond to excess demand in the way they had thought it would (the Phillips curve is dead), wages do (the Wage Curve is alive and kicking). That is, they could have their cake and eat it too: they realized that they could run the economy really hot and generate broad-based growth without unnecessarily running the risk of high inflation.

“The key to the whole thing,” as Chair Powell put it yesterday, is that almost no one believes that the Fed can’t tame inflation if it were to reappear — inflation expectations are firmly anchored on target. So they can afford to be very generous in bad times because everyone knows the Fed won’t let inflation expectations get de-anchored ever again — the great lesson of the 1970s’ stagflation crisis. In other words, they had come to realize that we live in the best of all possible worlds. And the systematic policy mistake of the past decade or decades was that they had been unnecessarily pessimistic and cautious.

So when Summers and Blanchard reached for the old ways of thinking, something entirely unexpected happened. Where there should’ve been a loud debate structured by the idea of fiscal discipline, there was one big yawn. The doyens were largely ignored or dismissed by both the technocrats and the politicians. This surprising development revealed that the intellectual revolution among elites, triggered by the Polanyian counter-movement from below that Trump rode to power, had been consummated. Yesterday’s press conference confirmed that the process of intellectual conversion of the technocrats is now complete.

Such were the makings of the perfect storm. With fiscal policy not only revived but virtually on steroids and with monetary policy accommodative for the foreseeable future, we’re now looking at the greatest economic boom in living memory. The Fed now reckons that the US economy will grow at 6.5 percent in 2021. Goldman is more bullish. The 38th floor at 200 West believes that the US economy will grow at 8 percent instead. The strategists are probably closer to the mark.

But this is the short-term conjuncture. Why would I call the turning point of the secular cycle?? The coming economic boom is not enough. The turning points of the secular cycle need not just the destructuation of features that generated the secular downcycle but also restructuration with features that generate the secular upcycle. What has created the conditions for new features to emerge and consolidate is the climate crisis. The success of climate activism has convinced elites that a solution must be found to the planetary impasse. Moreover, elites have come to believe that any solution to the climate crisis cannot come at the cost of the working-class — otherwise the threat from below will threaten the stability of the system as a whole. So the way is now open for at least a decade-long great green boom. The plan is now for the technocrats to handover control over economic affairs to the politicians, and for direct fiscal stimulus to give way to an infrastructure and green tech investment-driven economy. This is probably the only way out of the impasse of American class relations. Even those who don’t get it now will get it eventually.

As always, the short-term conjuncture and the long-term conjuncture are superimposed on each other. The economic boom in the short-run is now overdetermined. The long-term upcycle is still at risk. Above all, it is at political risk. So far the Harris-Biden people have refrained from talking about issues that stroke the long class war misleadingly called the culture war. This is also a good idea. Still, the risk remains on the books. But for the first time in fifty years, the exit from the secular downcycle has become probable.

Anyway, it’s morning in America. Enjoy the party!

Agreed that the Fed's belated empirical turn away from the Phillips curve is good news. At least now I know how I'm investing.

Aside: if you decide to sell merchandise, you could do this under the heading

"Policy Tensor Products."

I hope you are right!

While reading this, it reminded me of the idea of disjunctive presidents (https://www.nytimes.com/2019/05/15/opinion/trump-history-presidents.html). It'll be a decade before we know for sure, but it strikes me that if neoliberalism really did just die, then I think it's clear that Trump was a disjunctive president, with the disjunction Trump getting his party and America across being the collapse of neoliberalism.