The Term-Structure of Inflation Expectations

Are long-term expectations on the rise?

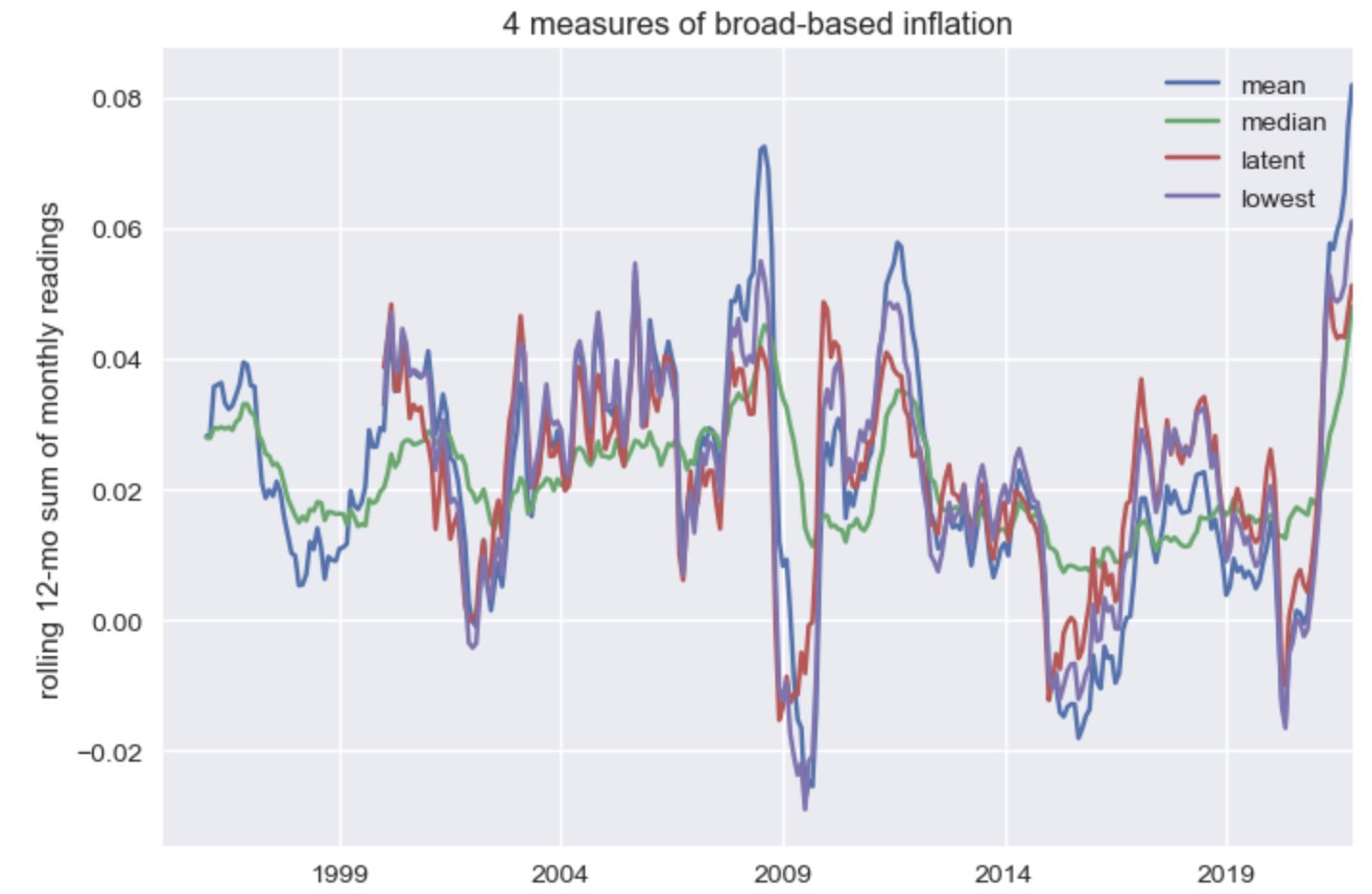

Some interesting pushback from folks on econ twitter. People seem convinced that the current bout of inflation is broad-based. That result can hardly be argued with:

But people seem to be less convinced that the current bout of inflation is not transitory but persistent. I am not a fan of the transitory vs permanent team sport. The issue is not inflation…

Keep reading with a 7-day free trial

Subscribe to Policy Tensor to keep reading this post and get 7 days of free access to the full post archives.